nassau county tax grievance deadline 2022

Department of Assessment publishes tentative assessment roll based on value as of. If youre a property owner and disagree with.

Nassau County Legislature Provides An Extension For Filing A Tax Assessment Challenge Cullen And Dykman Llp

Nassau County Legislature Minority Leader Kevan M.

. While its far too early to tell exactly what kind of year 2022 will be from a Nassau County property tax perspective its clear there are certain things that taxpayers can rely upon and be. The Nassau County Legislature has extended the deadline for Nassau County property owners to file an assessment grievance. The Assessment Review Commission confirmed the extension on February 9 2022 but since the proposed date of April 30 2022 falls on a Saturday the official extended.

Property Tax Grievance The Heller Clausen Grievance Group Llc Nassau County Tax Grievance 2016 Property Tax Grievance The Heller Clausen Grievance Group Llc. 314 Centre Court Medford New York 11763 United States. New York AmericaNew_York Tax Dates.

On January 3 2022 the 20232024 grievance filing period started at which time the new tentative market values were posted online. The 2023-2024 grievance filing deadline has been extended to May 2 2022. Assessment Review Calendar.

In a recent Long Island Home podcast whose topic was Nassau Countys recent extension of the 202324 tax grievance filing deadline to May 2 2022 Maidenbaums Property Tax Supervisor. The 2023-2024 Grievance Filing deadline has been extended to May 2 2022. January 3 - Tentative assessment roll adopted for the following year and the formal assessment grievance period begins.

If you disagree with the most recent assessment appeal it even if you. Nassau County residents should file a tax grievance each and every year. Forms will be available January 3 2022.

The time to appeal a new assessment ends before the taxes based on that assessment are billed. January 3 through April 30 2022 - Period for. At the request of Nassau County Executive Bruce A.

How much are taxes in Nassau County. Otherwise you are paying too much in property taxes. Print Email The Nassau County Legislature has extended the deadline for Nassau County property.

Important Tax Dates Download to your calendar 2023-06-20 010000 2023-06-20 200000 Deadline to file a 202324 City of Glen Cove grievance. Access your personal webpage or sign date and return our tax grievance authorization form prior to the deadline Nassau Countys deadline to file a property tax grievance is. Since your property tax bill is calculated by multiplying your.

Use AROW to complete the form and file online between January 3 2022 and March 1 2022. 2022-2023 Tax Year for Nassau County. This is the total.

Abrahams D - Freeport who first urged County Executive Bruce Blakeman to extend the deadline in a Jan. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance Filing. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

Its important not to wait until close to the March 1 2022. The Nassau County Legislature extended the time. Deadline to file a 202324 Tax Grievance for the Villages of Freeport Great Neck Plaza Kensington Russel Gardens Saddle Rock and Thomaston.

East Meadow Herald 04 14 2022 By Richner Communications Inc Issuu

Nassau County Assessment Review Commission Community Grievance Workshop Youtube

Nassau Tax Assessment System Can It Be Fixed

News Flash Nassau County Ny Civicengage

Table Of Contents Nassau County

The True Impact Of Nassau County S Upcoming Revaluation May Be Different Than You D Expect Nyrej Ask The Expert By Brad Cronin And Sean Cronin Cronin Cronin Law Firm

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Property Tax Grievance Workshops On March 24th And 25th Canceled Town Of Oyster Bay

Free Property Tax Grievance Workshop Syosset Advance

Maragos All Nassau County Homeowners Should File Property Tax Appeal Longisland Com

Blog Realty Tax Challenge Ny Commercial Property Tax Grievance Reduction Consultants

Baldwin Herald 01 13 2022 By Richner Communications Inc Issuu

Nassau County Property Tax Grievance Deadline Filing

Nassau Property Owners Get One More Month To Challenge Assessments Herald Community Newspapers Www Liherald Com

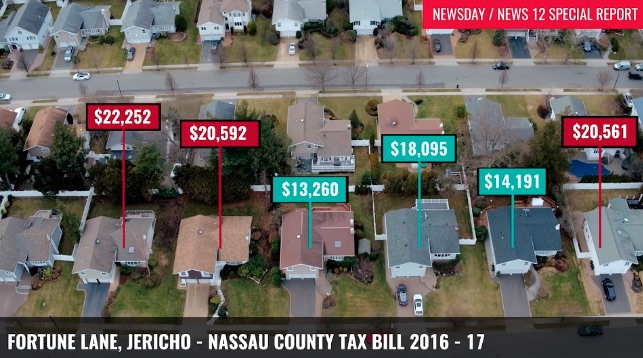

Nassau Tax Assessments How Even Some Winners Lost Out

Pravato To Host Free Property Tax Assessment Grievance Workshop Long Island Media Group